Invest into the highly sought after SDA Market Today!

With demand of Specialist Disability Accommodation (SDA) on the steady rise there is no better time than now to get involved in the market. Contact us today to start your investment in building houses for eligible NDIS participants to live an independent and happy life.

-

We Give Advice

We will help you understand what SDA is, what is required to be a SDA approved property and the steps involved to starting your investment.

-

We Find Tenants

From the moment the lease agreement is signed we will get to work advertising your property among our SDA network.

-

We Manage the Property

Once the property is ready for occupancy we will provide ongoing management of the residents. Ensuring a happy and safe environment whilst meeting all regulatory obligations.

-

You Reap the Rewards

Through investing in Specialist Disability Accommodation (SDA) you will be providing participants a place to call home whilst receiving significant returns.

Simplifying the complexities of the SDA Market

Being a highly regulated industry by the NDIA, navigating the SDA market can quickly become confusing. At Homely Housing we will help navigate the rules and regulations in order to make your process of entering and/or expanding your position in the market as seamless as possible.

Expert Network

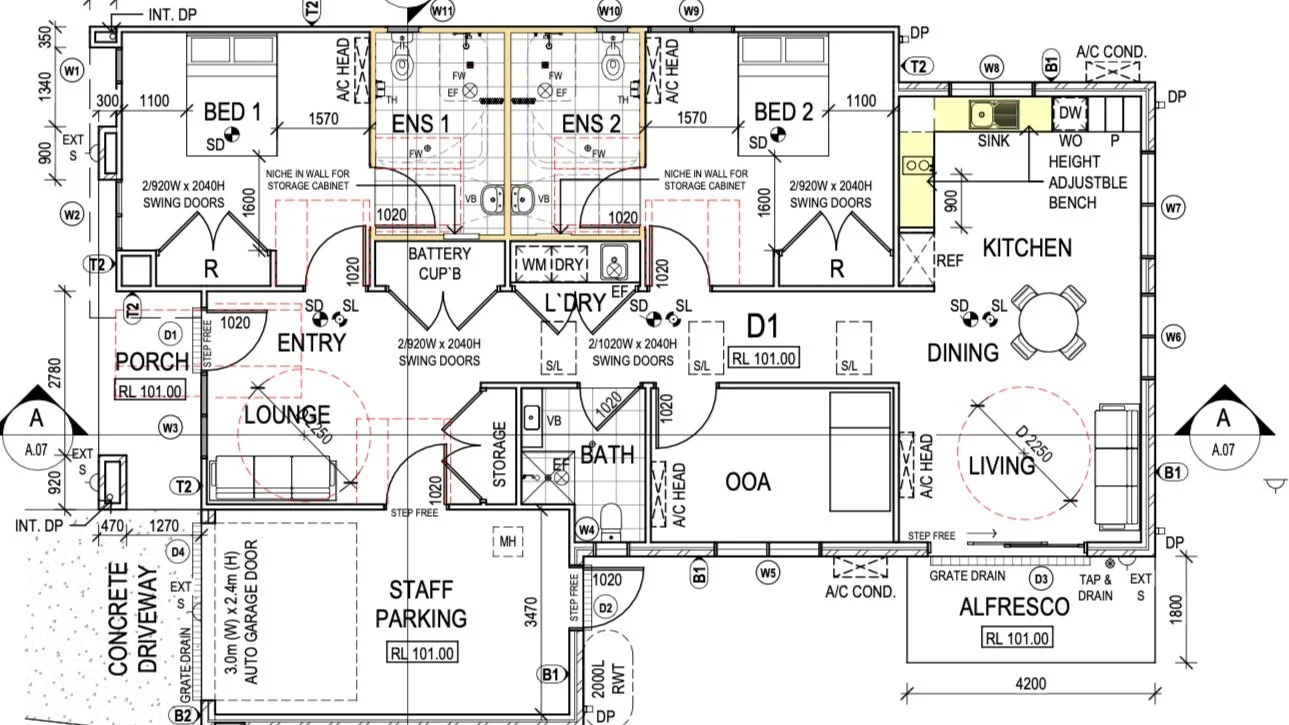

Whether you are an experienced builder or new to the market our network of experts will help you design and build a quality SDA home that meets all the requirements of a Specialist Disability Accommodation dwelling. Whether your property build is complete or construction has yet to be commenced, the moment you sign a lease agreement we will begin the search for tenants to occupy your SDA dwelling.

Partnering for Long-term success

At Homely Housing we strive to build long-standing relationships with our clients, maximising your potential in the world of Specialist Disability Accommodation (SDA).

Whilst there is substantial potential in your Return on Investment (ROI), no investment returns are guaranteed. That said, we at Homely Housing aim to give you the best returns possible in the market.

FAQs

Are SDA properties exempt from Land Tax (SRO Vic)

Referring to section 10 of the Land Tax Exemptions from SRO Victoria:

Land is exempt if it is occupied, or currently available for occupation as:

a residential service for people with disabilities within the meaning of the Disability Act 2006, or

an SDA enrolled dwelling provided by an SDA provider within the meaning of the Residential Tenancies Act 1997.

If only part of the land is occupied, or currently available for occupation as a residential service for people with disabilities, or as an SDA enrolled dwelling provided by an SDA provider, the exemption will only apply to that part.

This exemption extends to land where the facility is being constructed until the earlier of the following:

the date construction is completed

two land tax years from the date construction commenced.

Are NDIS properties a good investment?

NDIS properties, commonly referred to as Specialist Disability Accommodation (SDA) are high yield investments. In a market where standard residential rental yields are low, SDA properties can see an average yield of 10% + per year.

What is reasonable rent contribution for SDA?

Referring to the consumer vic website on NDIS reasonable rent contributions;

The NDIS (Specialist Disability Accommodation) Rules 2016 say you can receive a reasonable rent contribution (RRC) from residents. This applies to SDA residency and Residential rental agreements.

If a resident receives the disability support pension, their RRC cannot exceed:

25% of the basic rate of the disability support pension

plus 25% of any pension supplement they receive

plus 25% of any youth disability supplement they receive

plus all Commonwealth rent assistance they receive.

If a resident does not receive the disability support pension, their RRC cannot exceed:

25% of the basic rate of the disability support pension

plus all Commonwealth rent assistance they receive.

Can i change SIL providers?

Yes you can. As SIL providers and SDA providers are funded separately you can change SIL providers without leaving your SDA accommodation. If you do decide to move houses, your SDA funding will need to be reapplied.

What is the difference between SDA provider and SIL provider?

SIL and SDA are both different types of disability accommodation options. SIL stands for Supported Independent Living, and SDA stands for Specialist Disability Accommodation. Put simply SIL provides supports to people with physical or mental disabilities and want to live as independently as possible. These individuals receive supports through the presence of a carer.

SDA on the other hand refers to the actual bricks and mortar dwelling that approved participants live in. SDA funds are targeted towards the home, whilst SIL funds are targeted towards the care.